Our Expertise

We offer a comprehensive suite of services designed to help you thrive in a dynamic financial landscape.

Investment Banking

Comprehensive advisory, capital raising, and transaction execution across various asset classes.

Asset Management

We help clients extract maximum value from underperforming assets through expert valuation and strategic sales.

Trading & Execution

Efficient and timely execution of trades in Treasury Bills, Bonds, and Equities by dedicated product teams.

Research & Innovation

We provide nationwide market research and collaborate to develop innovative, customer-focused financial products.

Why Partner with Neon Trust?

Deep Market Expertise

From securities trading to asset management, our professionals bring years of hands-on experience and up-to-date market insights to help clients stay ahead.

Tailored, Strategic Advisory

We don't offer one-size-fits-all solutions. Our team works closely with clients to craft custom financial strategies aligned with their unique goals.

Integrity & Professionalism

We uphold the highest standards of ethics, diligence, and transparency. Every service we offer is delivered with precision, trust, and an unwavering commitment.

About Neon Trust

Neon Trust Limited is a Nigerian-based financial services firm offering Strategic Advisory, Securities Trading, and Market Training. Serving individuals, corporates, and institutions, we deliver expert guidance and asset management solutions across the evolving financial landscape. With a culture rooted in professionalism, innovation, and client-first service, Neon Trust is positioned to expand its footprint globally.

Meet the Team

A shining team you can trust

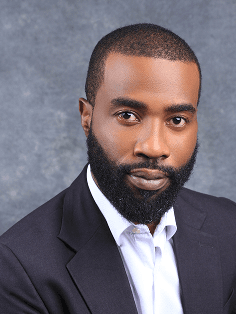

UGO NWANOLUE

MD/CEO

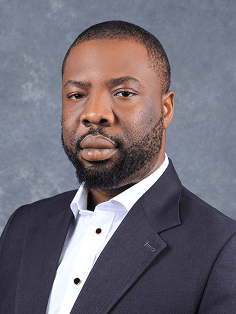

IKENNA ONO

TREASURER

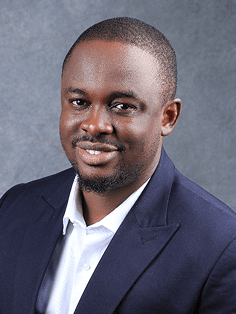

UGOCHUKWU ESEMENE

OPERATION LEAD

Our Commitment in Numbers

Assets Under Management, Driving Client Growth

Successful Financial Advisory Transactions

Client Satisfaction Rating, Built on Trust

* Figures represent industry benchmarks and key performance indicators.

Latest from Our Blog

Stay informed with our market insights and financial analysis.

Understanding the Psychology of Investing: Why Emotions Matter

When it comes to building wealth through investing, many people assume that success is purely a matter of numbers, charts, and market trends. While those elements certainly play a major role, there's another crucial factor that often gets overlooked — psychology.

Investing isn’t just a financial journey; it’s a deeply emotional one. The ups and downs of the market can trigger powerful feelings — excitement, fear, greed, even regret — and if not properly managed, these emotions can lead to irrational decisions.

Fear and Greed: The Market’s Emotional Drivers

Two of the most dominant emotions in the world of investing are fear and greed. Greed often pushes investors to chase high returns, sometimes entering overhyped markets at the peak. On the flip side, fear can drive panic selling, especially during market dips — even when those dips are temporary.

The challenge? Making decisions based on logic rather than emotion. That’s easier said than done.

The Power of Patience

One of the most underrated investing strategies is simply being patient. The market rewards long-term thinking, yet many investors are lured into short-term speculation. Time in the market almost always beats timing the market — but it requires discipline and emotional control.

Building a Strategy and Sticking to It

The best investors usually follow a consistent plan. Whether it's dollar-cost averaging, diversifying across assets, or maintaining a risk profile that matches their goals, successful strategies aren't based on hunches or headlines — they’re built on reason and restraint.

Final Thoughts

Understanding your emotional triggers and setting rules to guide your decisions can be just as important as understanding the stock market itself. Whether you're just starting out or have been investing for years, taking control of your financial mindset is a powerful tool for long term success.

Understanding Risk Management in Investment Portfolios

Risk is an inherent part of investing, and how an investor manages risk often determines the success or failure of their financial goals. Whether you’re investing in stocks, bonds, real estate, or alternative assets, developing a solid risk management strategy is crucial to preserving capital and ensuring long-term growth.

What Is Risk Management?

Risk management in investing refers to identifying, assessing, and prioritizing risks, followed by coordinated efforts to minimize, monitor, and control the probability of unfortunate events. In simpler terms, it means protecting your investment from potential losses.

Types of Investment Risks

Market Risk: The risk of investments declining due to economic developments or other events that affect the entire market.

Credit Risk: The possibility that a bond issuer will default on payments.

Liquidity Risk: Difficulty in selling an asset without a significant price cut.

Inflation Risk: The erosion of purchasing power due to rising prices.

Interest Rate Risk: Fluctuations in interest rates affecting bond values.

Understanding these risks is the first step toward mitigating them.

Core Risk Management Strategies

Diversification: One of the most effective strategies. Spreading your investments across asset classes and sectors reduces the impact of a poor-performing asset on your overall portfolio.

Asset Allocation: Adjusting the proportion of different asset classes (stocks, bonds, cash, etc.) based on your risk tolerance, investment horizon, and financial goals.

Rebalancing: Regularly adjusting your portfolio to maintain your desired asset allocation.

Stop-Loss Orders: Setting automatic triggers to sell a security when it reaches a specific price, limiting potential losses.

Hedging: Using financial instruments like options or futures to offset potential losses in other investments.

The Role of Emotional Discipline

Managing risk isn’t just about numbers and charts. Emotional discipline plays a massive role. Fear and greed often drive poor investment decisions. Successful investors stick to their strategy, even when the market becomes volatile.

Final Thoughts

While risk can never be eliminated entirely, it can be effectively managed. With the right strategy, investors can weather market downturns and stay on track toward their financial goals. Whether you are a seasoned investor or just starting out, understanding and applying risk management principles can make a significant difference in your investment journey.

Understanding the Importance of Diversification in Investment Strategy

In today’s fast-paced and often unpredictable financial markets, one concept continues to stand the test of time: diversification. Whether you're a first-time investor or a seasoned portfolio manager, diversification remains a cornerstone of any sound investment strategy.

What is Diversification?

Diversification is the practice of spreading your investments across various asset classes, industries, and geographies to reduce exposure to any single risk. Think of it as the old saying: “Don’t put all your eggs in one basket.” By investing in a mix of assets, investors aim to minimize losses while optimizing long-term returns.

Why Diversification Matters

Financial markets can be volatile. Stocks may fall due to geopolitical tension, inflation may erode the value of cash, and real estate markets can stagnate. Diversifying across different types of assets—such as equities, bonds, commodities, and alternative investments—helps cushion your portfolio during downturns.

For example, when equity markets dip, bonds often act as a counterbalance. Similarly, global diversification helps mitigate risks associated with a particular country’s economic or political issues.

Types of Diversification

Asset Class Diversification: Combining equities, bonds, cash, real estate, and even cryptocurrencies or commodities.

Geographic Diversification: Investing across domestic and international markets to protect against country-specific risks.

Sector Diversification: Spreading investments across different industries like healthcare, technology, energy, and finance.

Style Diversification: Balancing between growth stocks, value stocks, and dividend-paying investments.

The Risk-Return Balance

Diversification is not about eliminating risk entirely—no strategy can do that. Instead, it’s about managing risk intelligently. The goal is to achieve more stable and consistent returns over time, rather than chasing short-term gains.

It’s important to understand your own risk tolerance and investment goals. While a younger investor may lean toward high-growth assets, someone approaching retirement may prefer capital preservation and income generation.

Conclusion

Diversification remains a timeless principle in the world of investing. While it doesn't guarantee profits or protect against all losses, it significantly improves your chances of achieving long-term financial goals with greater confidence and stability.

In uncertain times, a well-diversified portfolio can be the difference between reacting emotionally to market swings or navigating them with clarity and control.